Investment gold and silver as an increasingly popular asset in Bulgaria - part 1

Published on 31 July 2023

The tendency for and interest towards investing in gold in Bulgaria has seen a number of significant changes over the past few decades. Local investors are more and more likely to regard the precious metal as a viable store of value for their savings.

In a series of three publications, we are going to give you a detailed analysis as to why precious metals seem like an increasingly attractive asset to investors.

The first topic we are going to delve into is the effect of economic crises and recessions on the popularity of gold and silver in comparison to other traditional assets.

What drove Bulgarians to the practice of investing?

Over the course of its short history after the fall of the communist regime in the 1980s, countries like Bulgaria went through hyperinflation and devaluation of the official currency, bank crises, and a significant number of other social and political reforms. Despite these challenges, throughout this critical time in our history, the local investment culture was mainly focused on the most classic form of asset - real estate. This tendency began to slowly shift towards more modern methods of protecting one’s wealth after the Global Financial Crisis of 2008-2009 and the resulting recession. The events that shook the housing market in Western Europe and the USA caused several small and large banks all over the world to become insolvent - a clear sign that the real estate market was severely overtrusted in economically developed countries. The now-fabled excess of high-risk subprime mortgages, which in itself showed negligence towards several indications of their inflated value, gave the global economy an initial push towards a large-scale crisis.

Bulgaria experienced the effects of this housing crisis with particular severity - a result of the traditionally speculative nature of small economies, which are in turn closely tied to the developed ones. The economic processes that took place after the economic crisis managed to change the mindset of a significant number of Bulgarian investors, driving them to search for a safeguard for their money in non-traditional forms such as assets, government obligations in economically developed countries, direct capital investments, and last but not least - investment gold and silver.

A detailed look into the key economic factors that drive global markets and directly affect the appetite for investing in precious metals today

The market dynamics between 2020 and 2023 parallel the Global Financial Crisis of 2008-2009. The world went through its greatest challenge in modern history - the SarsCov19 pandemic, coupled with the war between Russia and Ukraine, the economic tension between China and the US, Brexit, and a series of other earth-shattering events. All of this contributed to the "turmoil" that changed and rearranged several industrial and business sectors. This environment created economic conditions that threatened the norm that the world today accepts as “globalisation”. The established supply chains also experienced disruptions - whole industrial sectors shut down, and millions were left unemployed. The international equity and commodity markets reacted with adverse volatility for the majority of this time frame.

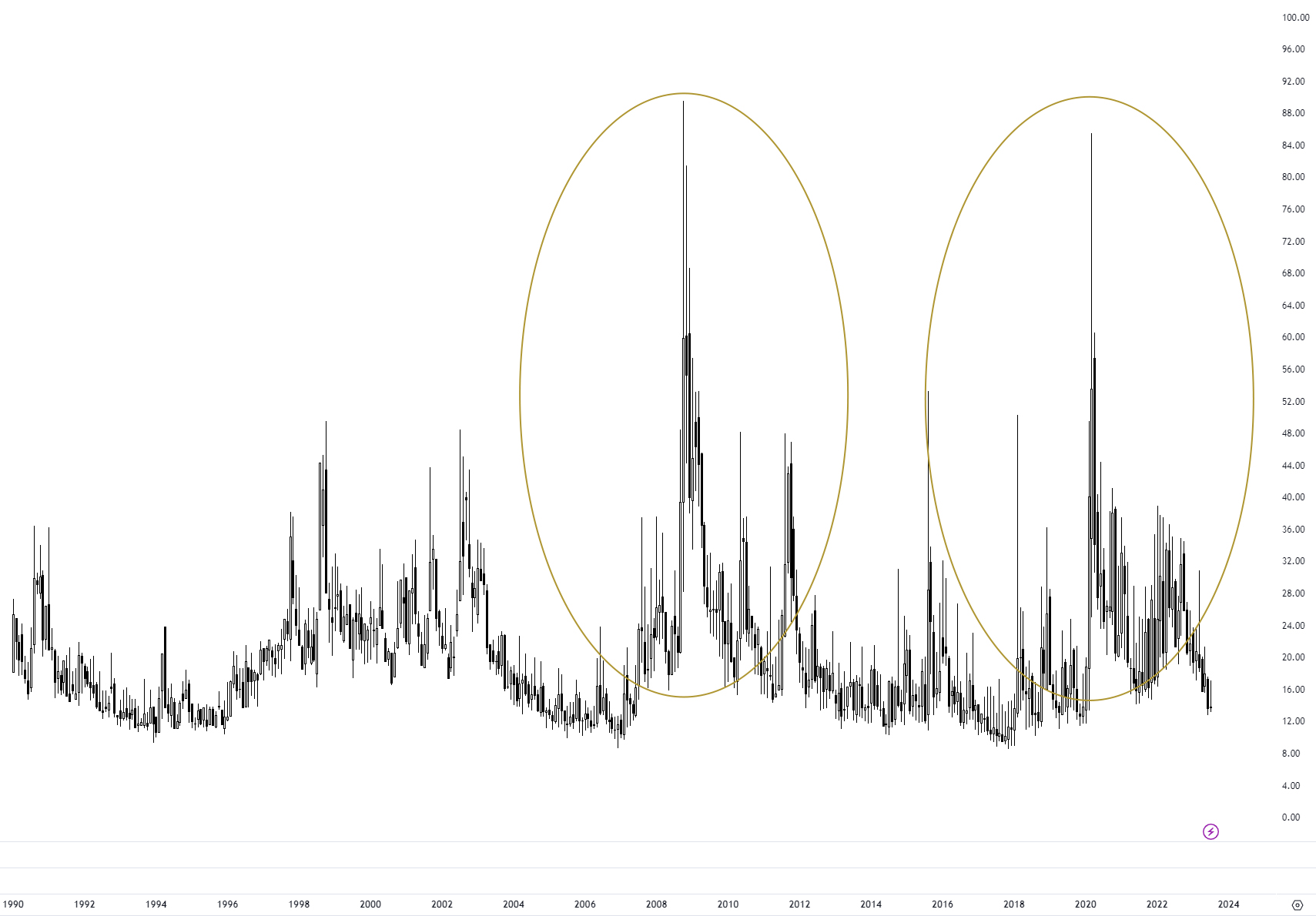

The VIX index, which is considered an indicator of the volatility of the most popular American index - S&P 500 - closed at a record high level over this period.

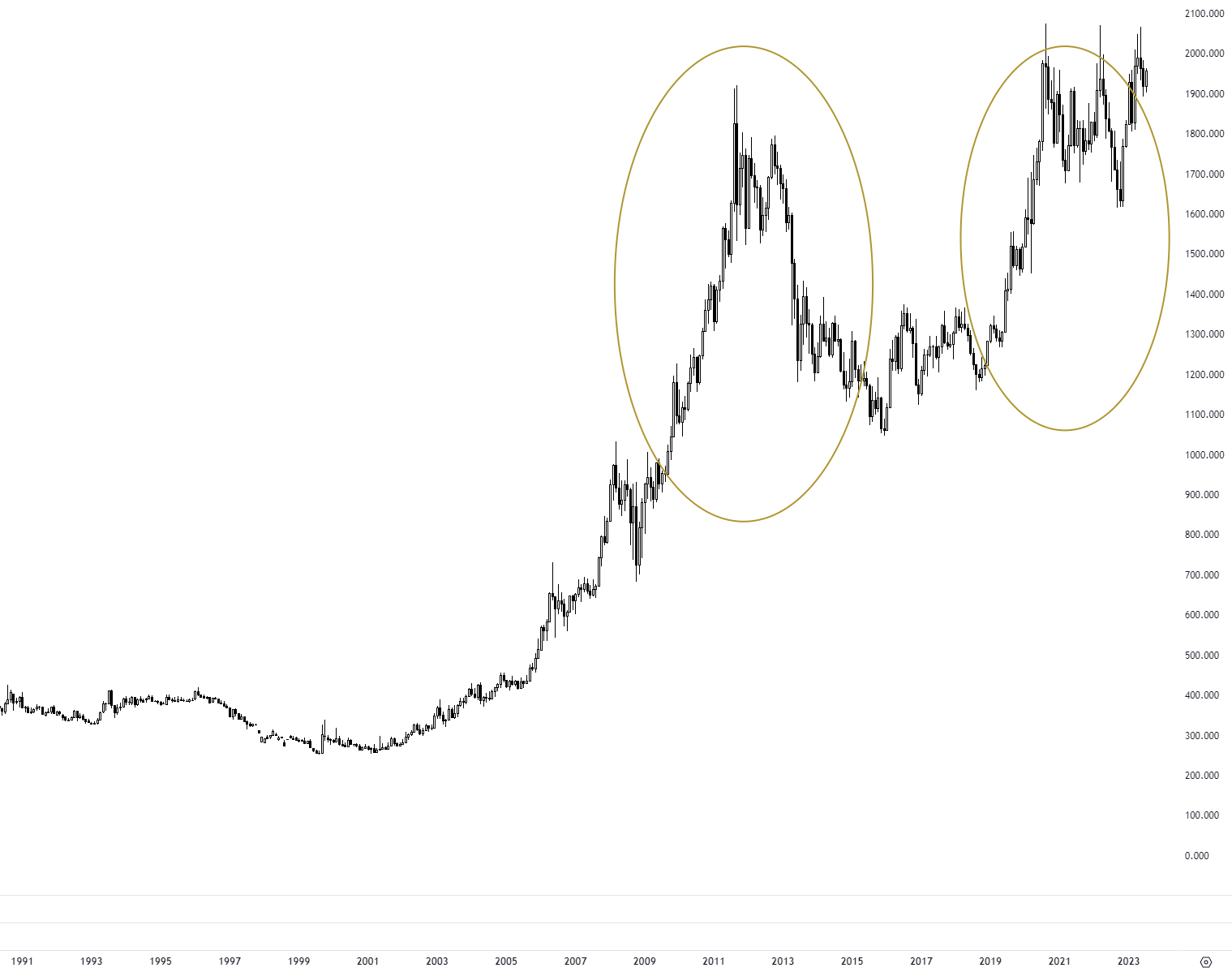

The correlation between the S&P 500’s volatility and the peak in the price of gold, as shown in the following graphic, is clearly evident.

The main indices went through a multitude of corrections in their own right, followed by instances of sudden recovery and record highs. It was not rare for the indices to undergo unprecedented fluctuations in the range of 35-40%. Considering the huge capitalisation of the world’s leading indices, the volatility could be measured in tens of trillions of United States dollars.

S&P 500, as a reflection of the 500 most developed companies in the American stock market, was the most volatile out of all of them. As of today, a large part of these caps is in the high-tech industry, which was the sector that underwent the most dramatic and rapid shift in sentiment and demand. This fact caused the entire industry to undergo never-before-seen levels of restructuring and expansion. It also resulted in the implementation of innovative services and products available to businesses as well as the wider public.

All leading indices in the respective timeframe exhibit identical behaviour.

The DOW is considered a benchmark for the state of heavy industry and a direct reflection of the backbone of the American economy. By using this index we can trace the provided capital of over 20% in the period of easily accessible liquidity.

The unprecedented economic environment caused by the pandemic and the practically “closed” economy at the beginning of 2020 forced the Central Banks of the developed world, including the US Federal Reserve and the European Central Bank, to sharply alter the course of their monetary policies.

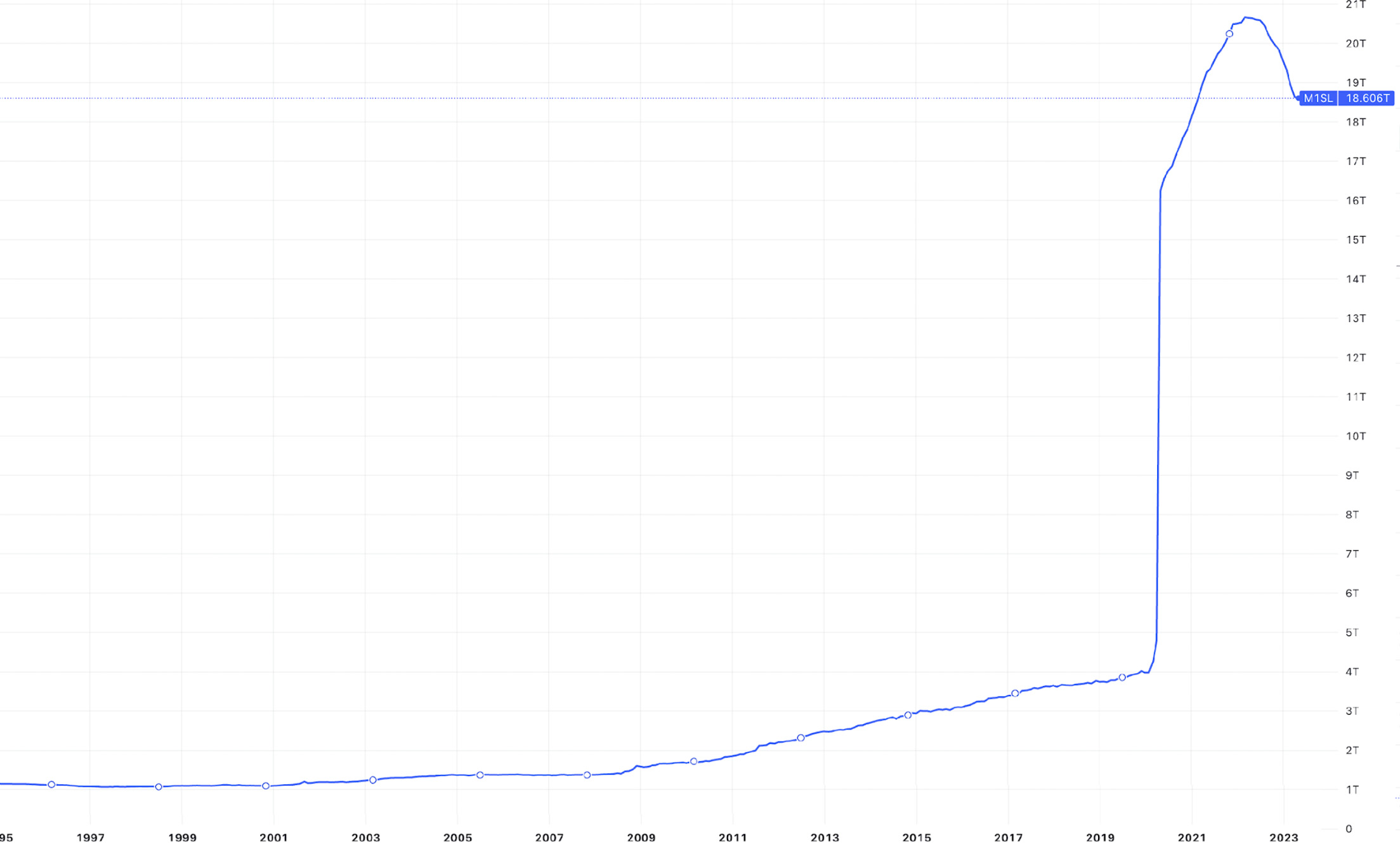

For 6 months, through a series of economic security programs, the monetary regulators printed and injected new money into the system over the mind-boggling 13 trillion US dollars.

In the United States alone, 5.2 trillion dollars were injected into the economy during the first two-quarters of the pandemic, and another 2 trillion dollars in the form of fiscal stimuli directly accessible to the American consumer.

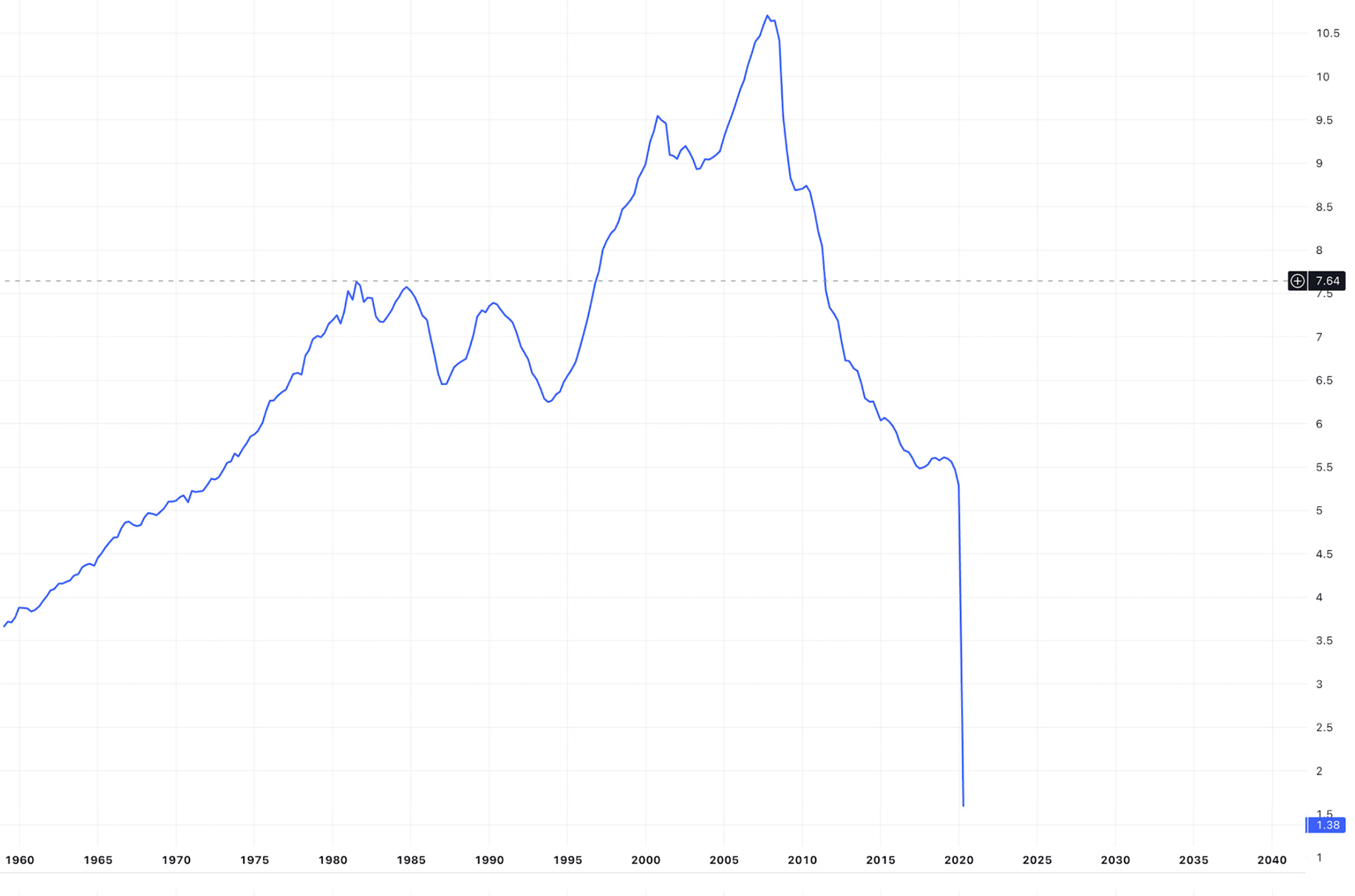

This contributed to an unprecedented increase in a number of monetary aggregates, including the base M1 “cash and tax benefits” (also known as “narrow money”), but also to the inability of this money to participate in the economy - the M1V index that in turn created a perfect storm for the supply chains and, and led the foundation for inflation.

However, the slow pick up of the M1V index caused the inflation to accelerate relatively slowly in the first 14-18 months of the start of the pandemic.

The interest rates over this period stayed close to 0%, which improved the dynamic of the global asset, stock, and cryptocurrency markets and the resulting indices and exchange-traded funds. The appetite towards higher income among investors created a basis for the record-high prices of the aforementioned assets, which are as follows:

- S&P 500 - 4,796.56 points on 03.01.2022

- Dow Jones - 34,200.67 points on 16.04.2021

- Nasdaq 16,057.44 points on 19.11.2021

- Gold XAU 2074.88 USD/Oz in 08.2020

- Bitcoin 67,566 USD on 08.11.2021

- Crude Oil 123,70 USD in 2022 - while not the highest price, it exemplifies the high volatility of the price-per-barrel in March: from 23 USD in 2020 to 130 USD in 2022.

Stay tuned for part 2 of our series of publications exploring the evolution of investment practices and their relation to monetary metals from the time of the “gold standard” to today - with a focus on Bulgaria.

The next article will present an analysis of the behaviour of gold during periods of inflation and the factors that affect its price.