Investment gold and silver as an increasingly popular asset in Bulgaria - part 2

Published on 21 August 2023

The dynamic economic environment in Bulgaria has been stirring local investors’ interest towards gold and silver as a way to preserve their wealth to a larger and larger extent.

In our previous article we analysed the effects of global economic crises on the investment habits of Bulgarians.

Today we are continuing our exploration of the topic with a historic and contemporary look inside gold’s behaviour on the market - its relationship with the US dollar and the factors that affect its price.

Gold and the US dollar

During the time of the significant changes in the behaviour of gold on the market described in the previous article, the US dollar further demonstrated its known status as a global reserve currency. Contrary to the popular belief that the USD/Gold ratio is negatively correlated, even the strong dollar could not cool down the demand for gold.

The DXY index is considered the measuring unit for the buying power of the USD by weighing its value against a portfolio of six other major currencies. The DXY levels were the highest they have been over the past 10 years. This contributed to the high interest rates on US Government bond yields, which also failed to affect the increased investors’ sentiment. These factors are all traditionally considered negative to the demand for precious metals.

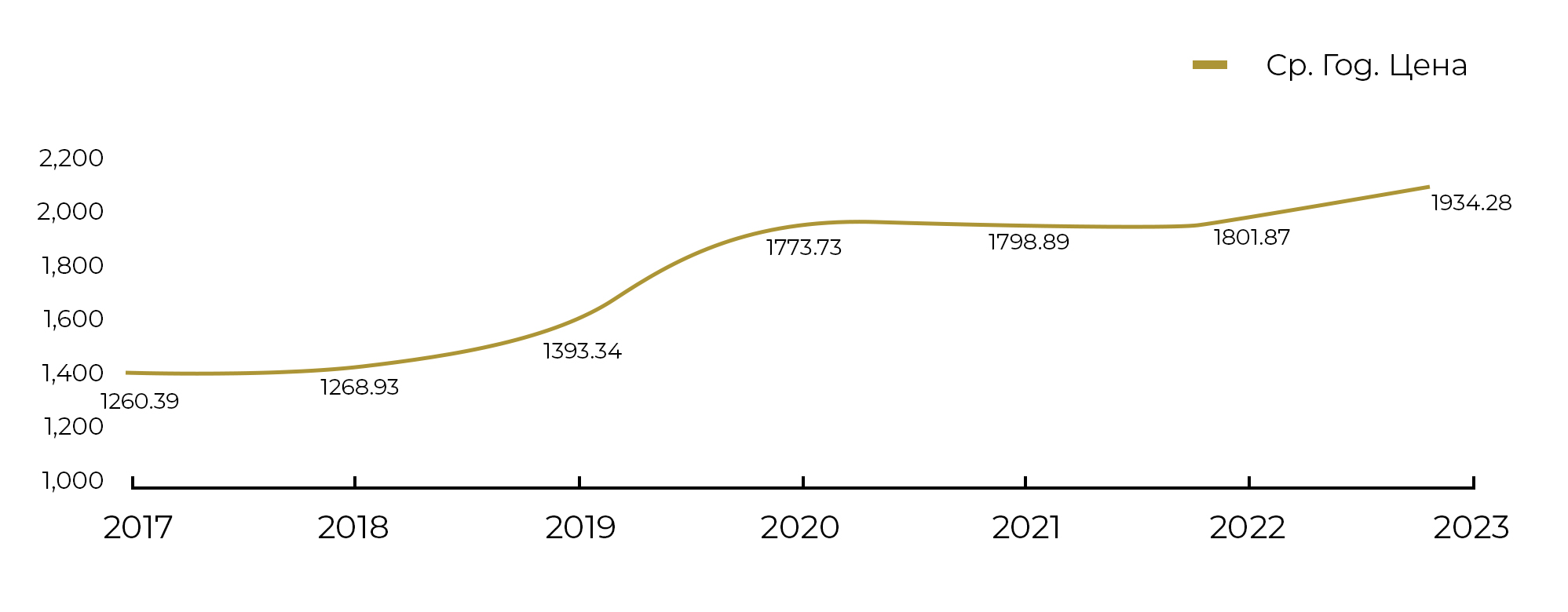

Despite the strength of the US economy, the price of gold reached the record-breaking 2060 USD per troy ounce on several occasions. The mid-year average price of this metal over the past three years was also within the record-high values of:

Gold is traditionally considered a hedge for one’s savings and natural financial insurance against rising inflation. This notion dates back to the time of the “gold standard” when the US dollar was backed by physical gold. Ostensibly a logical and idealistic structure of the monetary system, it did not entirely reflect reality. The growing and developing macroeconomic environment in the US in the 1950s and 60s necessitated a more flexible approach to back up the currency standard. Gold is, after all, a commodity that is difficult to mine, transport and store, which causes issues in the transaction with money in the real economy. Or to put it in simple terms - the world does not have the capability to mine and process a sufficient amount of gold in a timely manner.

Gold and inflation

The gold standard in and of itself excluded inflation as a possibility, keeping the money in circulation at the level of the current gold holdings, which prevented governments from injecting new liquidity every time the need arose.

After World War II, the US, as a winning side, began imposing the dollar more and more as a main form of currency on a global scale. All Allied countries started using the dollar as an exchange currency among themselves. However, the formal use of gold as a back-up created the conditions for inflation and led to yet another severe recession in the 60s, proving once again gold’s inability to serve as a parallel to the modern macroeconomic environment. In August of 1971, Richard Nixon followed Great Britain’s example and put an end to the US dollar’s ties to gold. This plunged the world into a new monetary era - one of currencies backed by the government that issued them.

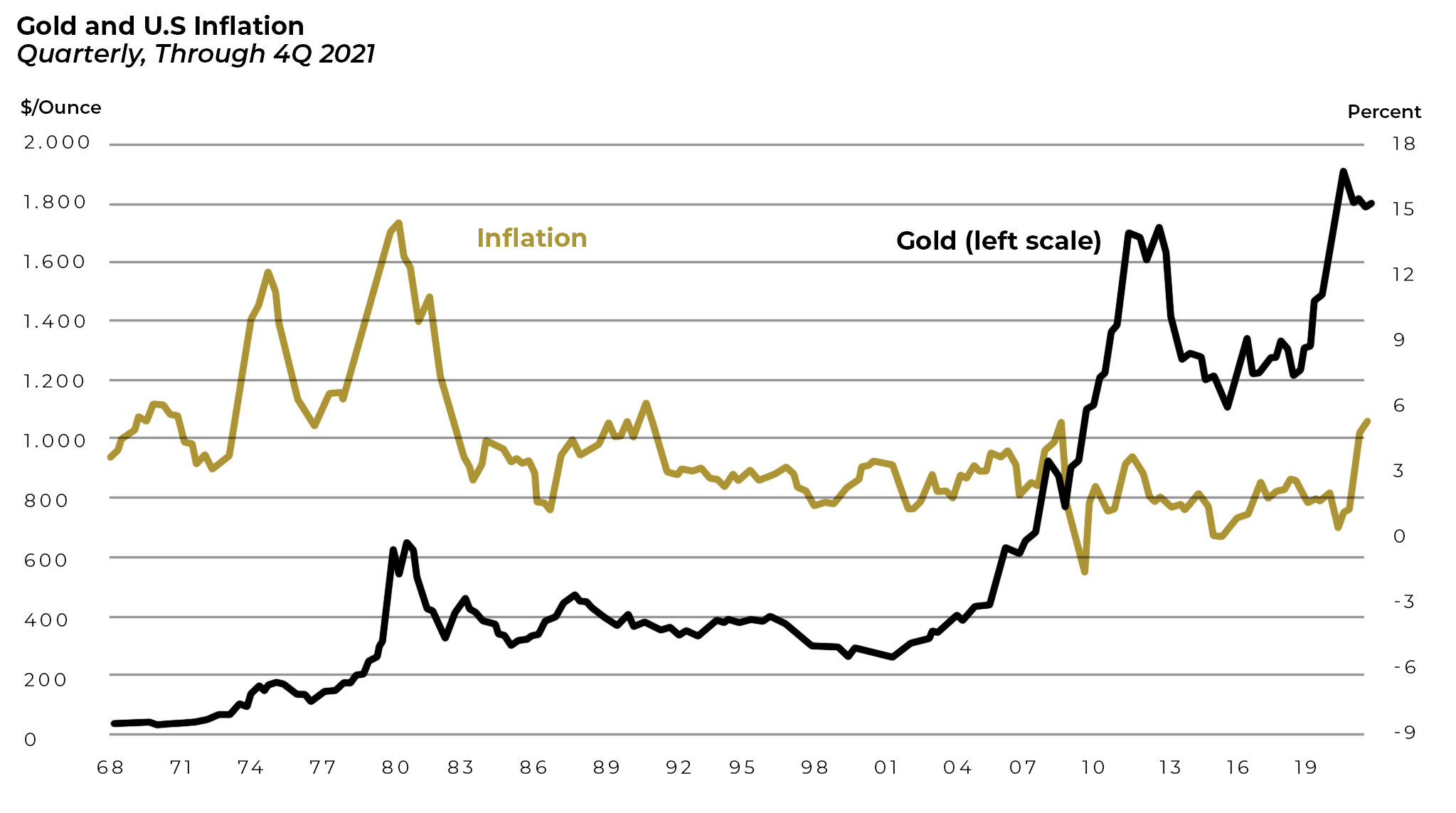

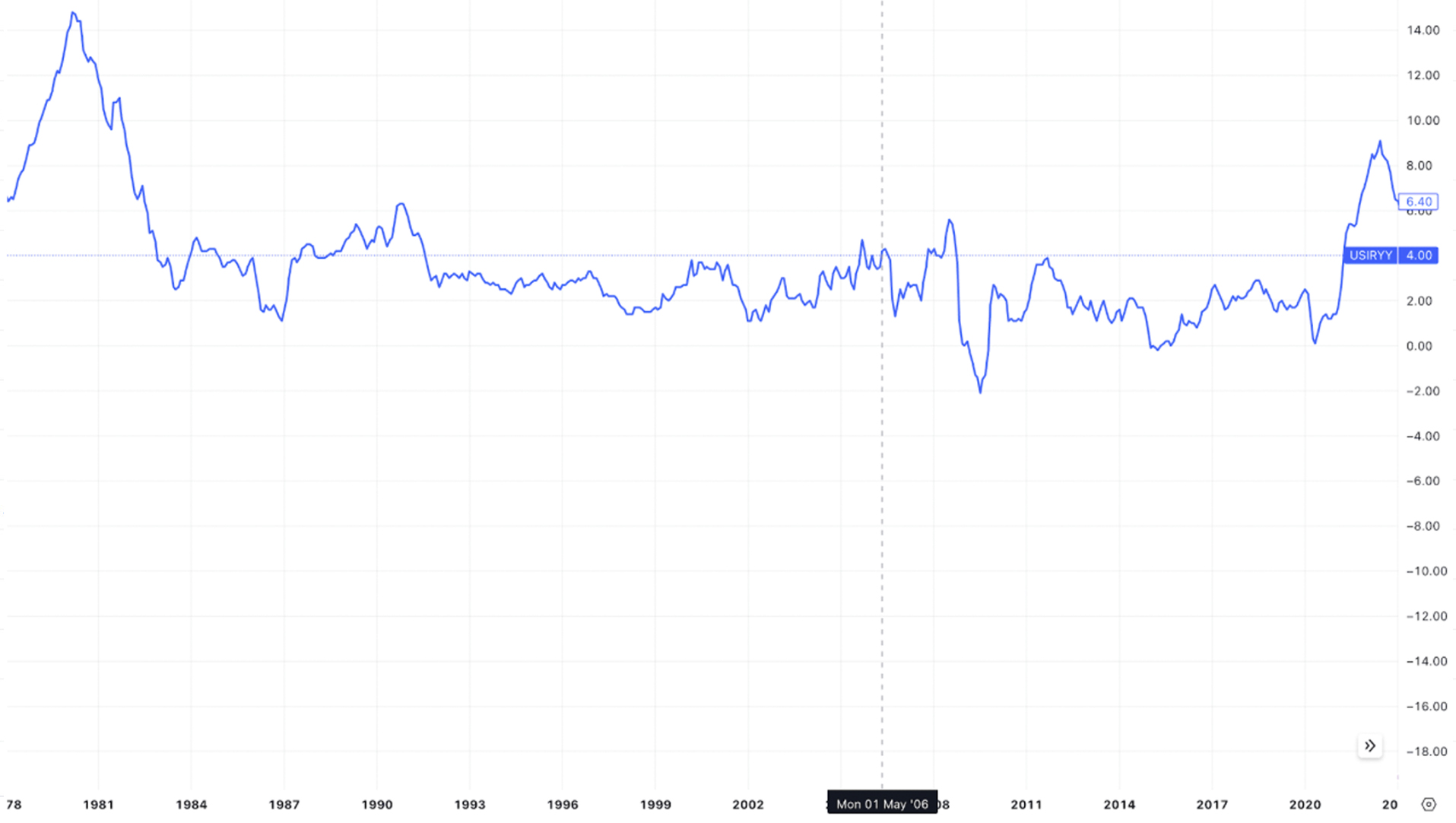

The view that gold is one of the best methods of protection and insurance against inflation is still widespread to this very day. The notion goes that high inflation inevitably leads to demand and, by extension, a rise in gold prices. The graphic below illustrates the correlation between real inflation - the CPI index - and the price of the metal.

The correlation between the two variables is about 11%. This means that in 11% of cases, high inflation corresponds to a rise in gold prices.

Towards the end of 2020 and the beginning of 2021, once the lockdowns passed and the restrictions were lifted, the world’s economy entered a state of acceleration. The new money in the system (previously demonstrated through M1), quickly increased its spending velocity. The economy resumed its function and the United States’ GDP started growing in leaps and bounds by the month. The fiscal stimuli went into circulation.

This led to a major rise in inflation, albeit with a delay, which reached 9% in the span of 9 months - record high levels in the US in the past 50 years.

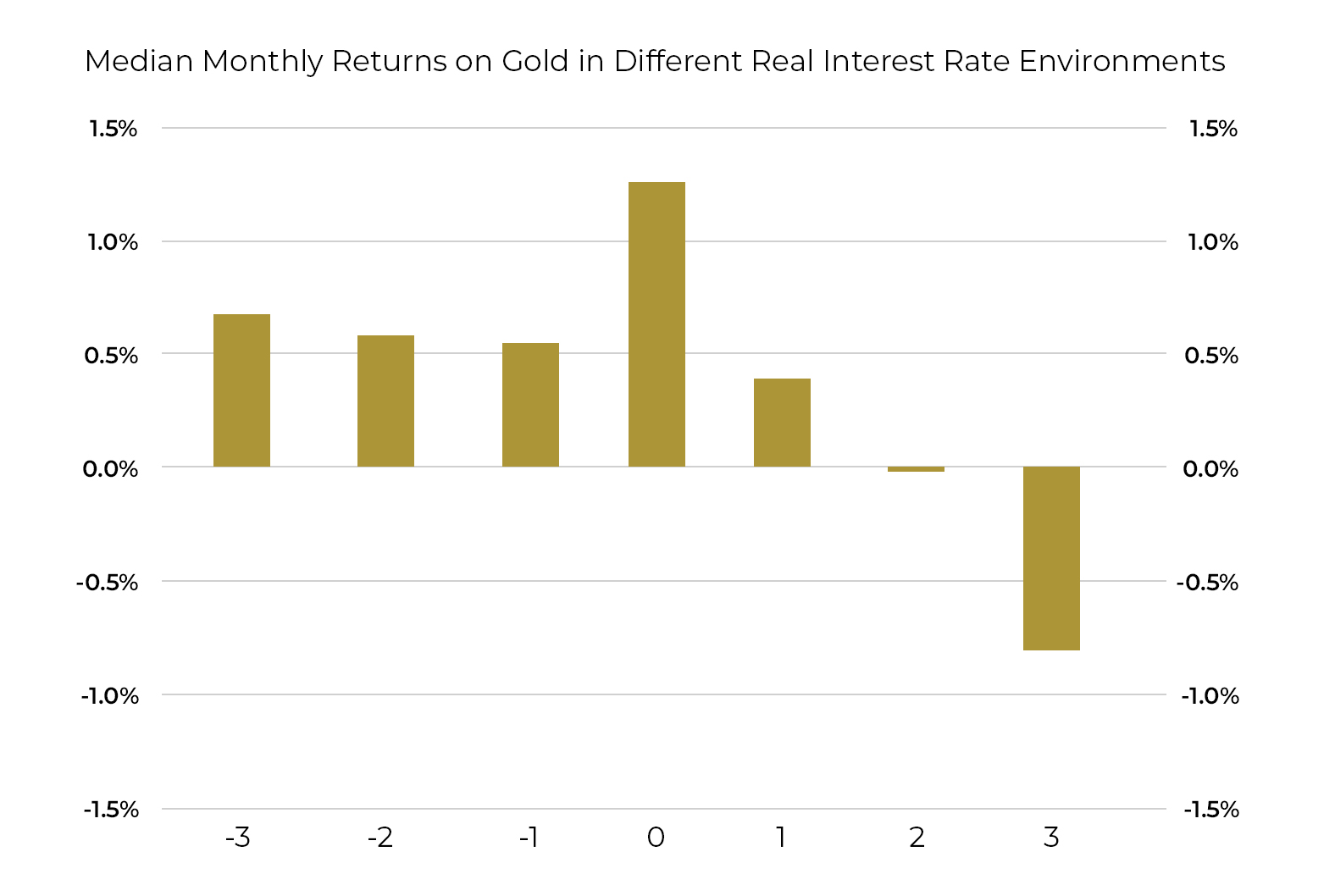

Under these circumstances, the Central Banks were forced to implement more hawkish monetary policies by raising the main interest rate as a way of extracting surplus liquidity out of the market.

These are factors that truly correlate to a large extent with the drop in the number of investors gravitating toward gold due to the fact that the yield of gold would be lower than the real interest. The result is, respectively, a correction in price.

Median monthly returns on gold in different real interest rate environments

% inflation per year in the USA, 1980-2023)

Geopolitical factors

The geopolitical situation is also a fundamental factor in determining the demand for gold and silver due to the fact that gold has the status of a and has a millenia-long history as a form of currency. This sentiment runs in the blood of each of us.

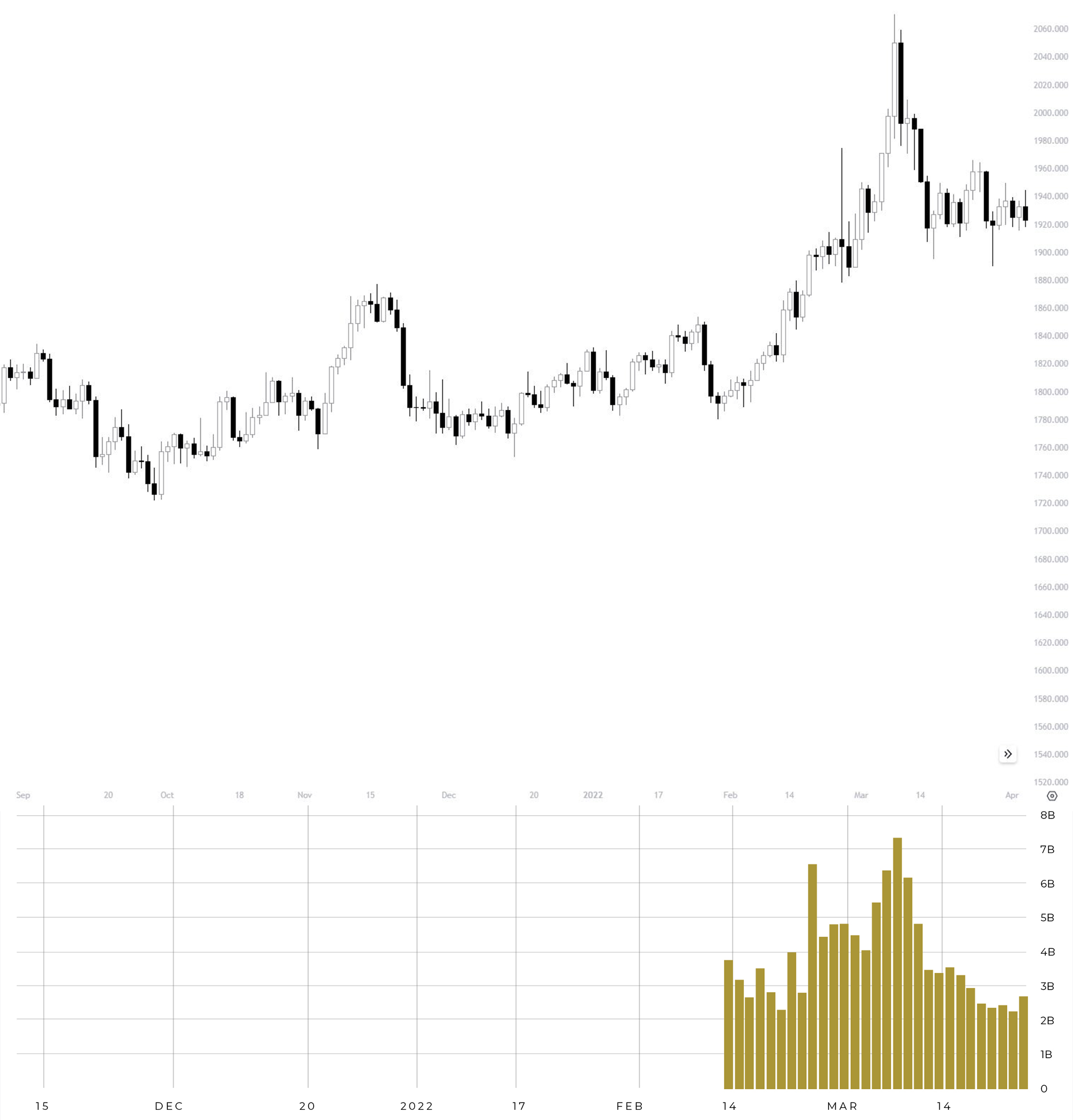

It is no coincidence that in times of war, military offensives, natural disasters, or political instability of all kinds, investors’ sentiment towards the metal grows. We saw proof of that in the timeframe we examined in the previous article - the conflict in Ukraine that started in March of 2022 and continues to this very day.

The initiation of the war in Ukraine in 2022 raised the demand for and the price of gold to a new historic height in a manner of weeks. During the initial period, every piece of news coming from the region became the catalyst to a sudden spike in gold price and demand.

In the investment circles there is a popular belief that when an asset becomes so popular that even counterparties who have no experience in investing flock to it, then it has gone into overbuying mode.

Macroeconomic factors

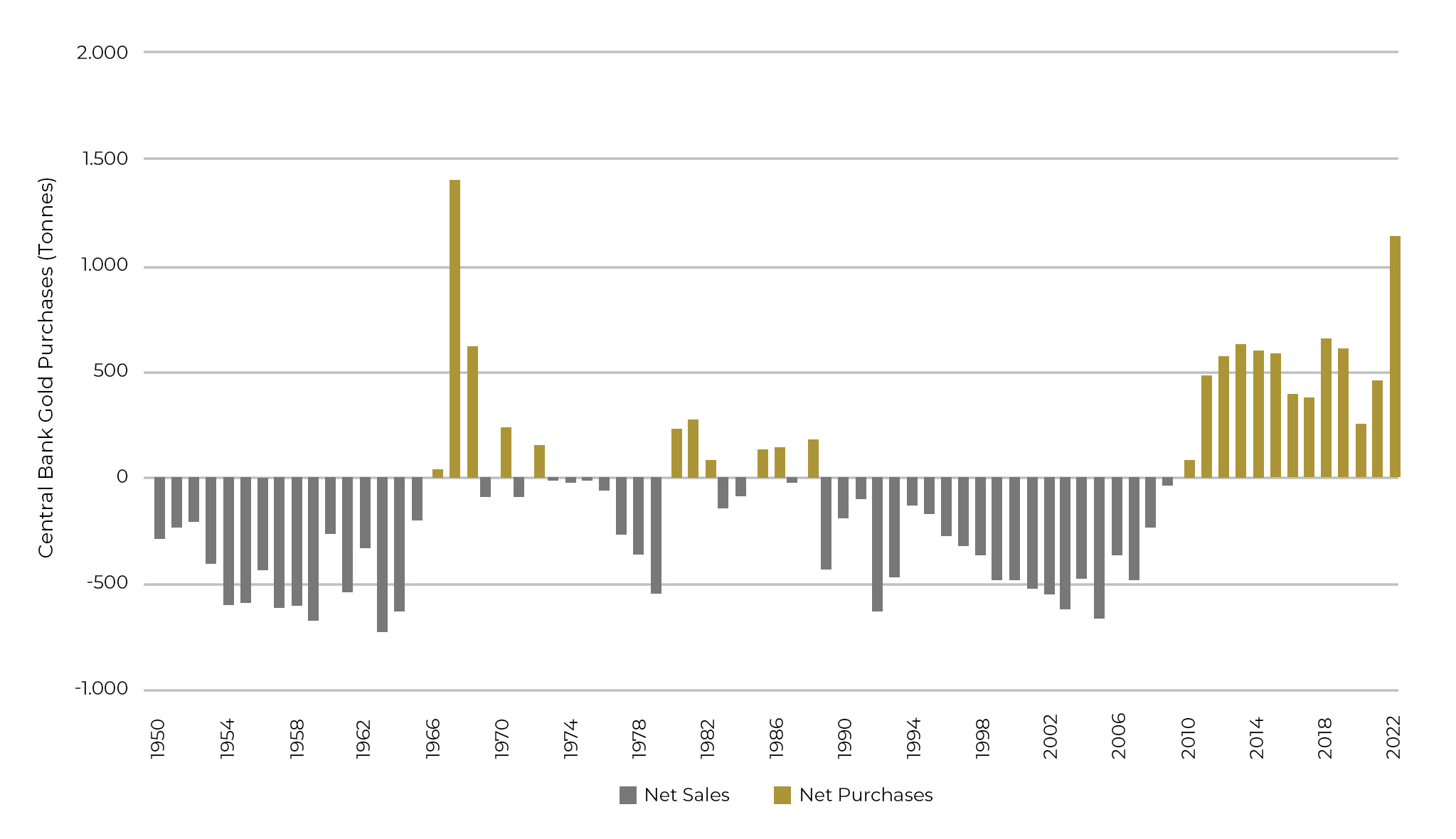

The behaviour of the central banks has been established as a main factor in a large number of today’s investment strategies and trading algorithms. Investor sentiment towards gold is considered a “lagging” indicator for upcoming macroeconomic events.

The analyses usually assume that the behaviour of the central banks is an indication of the economic environment for the next 10-15 years and/or the next economic cycle.

In 2022, the leading central banks set a gold acquisition record for the past 50 years, surpassing 1000 tonnes. The last time this happened was in 1967, when the gold standard was still a factor.

Another macroeconomic factor is the “silent” economic war between the US and China. The result is a polarity reversal in a number of sectors, diversification of the supply chains, and the division of the global markets into an Eastern and a Western one.

All of this directly affects the liquidity of the traded currency and indirectly influences monetary metals such as gold and silver.

The key market factors for determining price levels

As a direct participant in the supply chain in this industry, Bulmint has an expert understanding of the formation of and logic behind the pricing of gold. Our business is tied to every stage from the mining to the realisation of the investment product on an end-client level.

As a large-scale producer that offers a wide variety of services in the sector, Bulmint has developed extensive expertise in market trends. Our approach to the market starts from mining and encompasses every link in the supply chain all the way up to retail, which gives us direct experience with that aspect of the sector as well. There is a considerable lag between the demand and overall appetite in the investment - wholesale - retail segments. A good example of this is the valuation of the public gold and silver mining sector. The closer the sector is to the end customer, the more reactive it is to fundamental events. We have noticed a lag of 3 to 6 months in the demand in each segment of the sector, which results in different evaluations in the public sector. The most important factor that directly influences the price of the metal, as is the case with every other asset on the market, is the market activity and volume of the completed transactions and operations globally. It is important to note that international markets are connected. They form a global network of separate deals and operations centred on an asset, based on which said asset gets algorithmically valuated.

It is important to note the price-determining factor - the volumes and number of overall executed trades. Conversely, in derivative-like options futures and contracts take up the most significant part. The reality is that contracts that result in real deliveries of metal in exchanges like COMEX, NYMEX, LME, MCX DGCX и HKEX rarely exceed 5-6%. Most of the contracts are used for hedging. This is also true for most other assets that are listed on the global market.

Our next and final article in this series will analyse the practice of precious metal investing and how it differs between gold and silver.